Funding Solutions You Can Bank On

Get pre-approved today!

This does not impact your credit.

Client Testimonials

Fund Your Business.

Fund Your Life.

Business Line of Credit

Leverage a revolving line of credit and only pay for what you need. Access funds at your pace, as your business needs

0% Business Credit Stacking

Launch your business with the confidence of multiple 0% interest accounts. Enjoy cash accessibility with revolving credit at a 0% interest rate.

Asset Based Lending

Unlock the power of your company’s assets. Leverage your inventory, equipment, or receivables into the funds you need to grow and sustain your business operations.

Long Term Business Loans

Experience the reassurance of a traditional process with lower payments spread over a longer term.

Short Term Business Loans

Unlock quick access to funds for any business expenses. Your solution to fast, convenient financing when time is of the essence.

Personal Loans

Secure up to a five-year personal loan to manage your credit card balances, enhance your score, and qualify for 0% funding.

Bring Opportunity to Everyone

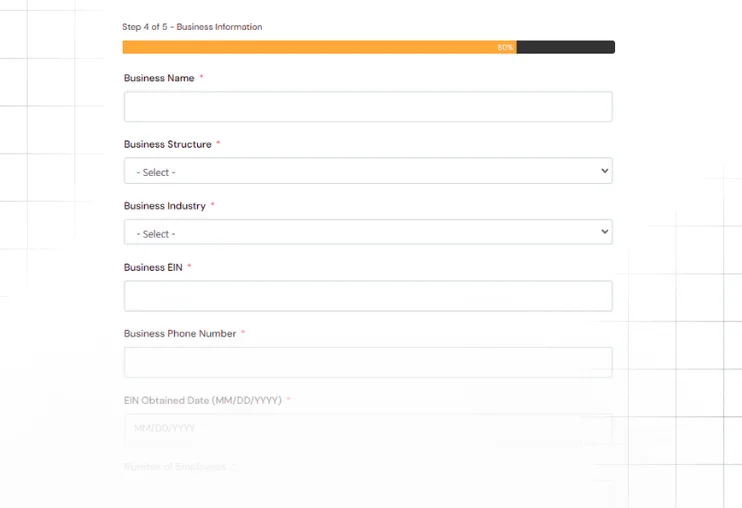

01

Pre-approval Form

02

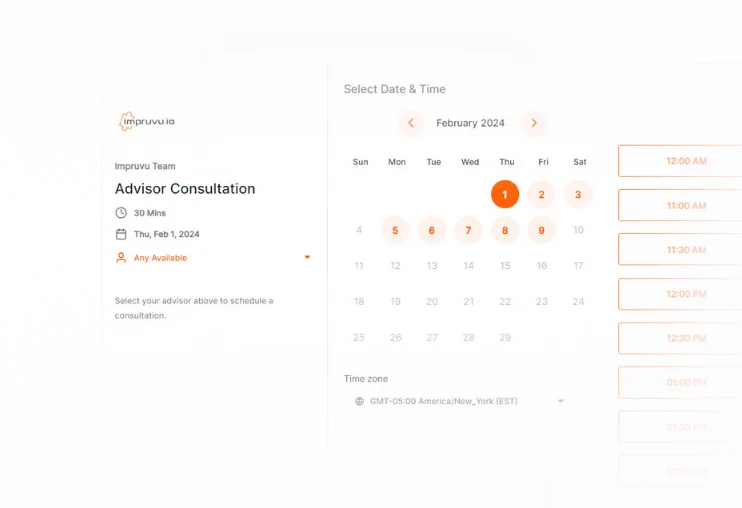

1-on-1 Consultation

03

Digital Onboarding

04

Funding Process

A Better Funding Experience

Jon Stalcup

Ivan Molina

Alex Green

Consultation Notes

– Lower your credit card utilization on the individual accounts that are significantly over the stipulated 30% utilization rate.

– Avoid opening new credit accounts or incurring hard inquiries to keep your applications within the desired range. If this information is accurate and thereare no recent accounts missing from this report, you are in a strong position regarding your credit score and lack of recent derogatory items or hard inquiries.

Streamline effective funding.

Quick Prequalifying

Experience a streamlined prequalification process, ensuring you quickly find the right products or services tailored to your unique business needs.

Easy Onboarding

Unlock quick access to funds for any business expenses. Your solution to fast, convenient financing when time is of the essence.

1-on-1 Consultations

Unlock quick access to funds for any business expenses. Your solution to fast, convenient financing when time is of the essence.

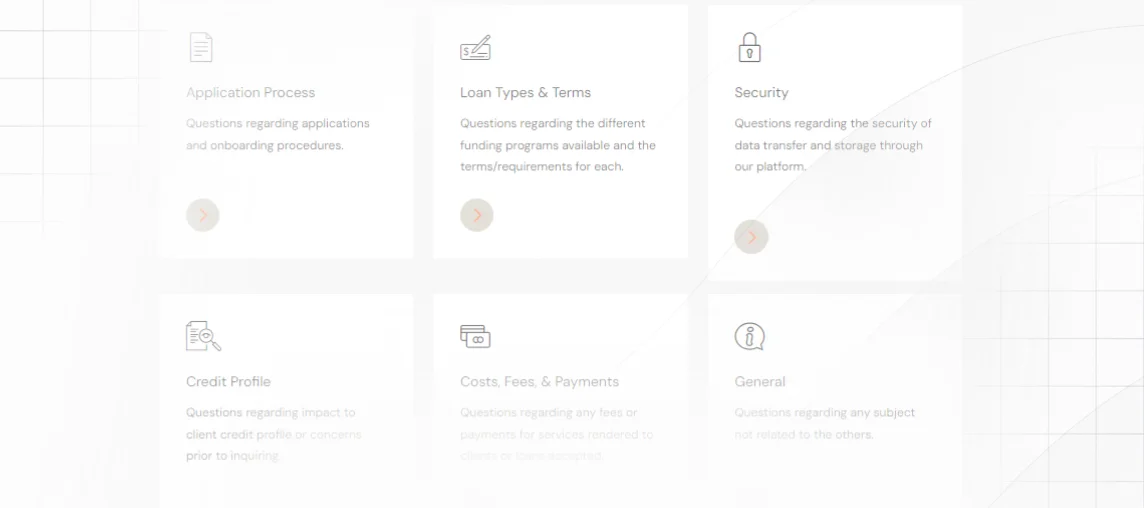

Guided Solutions

Access our comprehensive help center and FAQs, along with tailored educational materials, designed to guide you through every step of utilizing our solutions effectively.

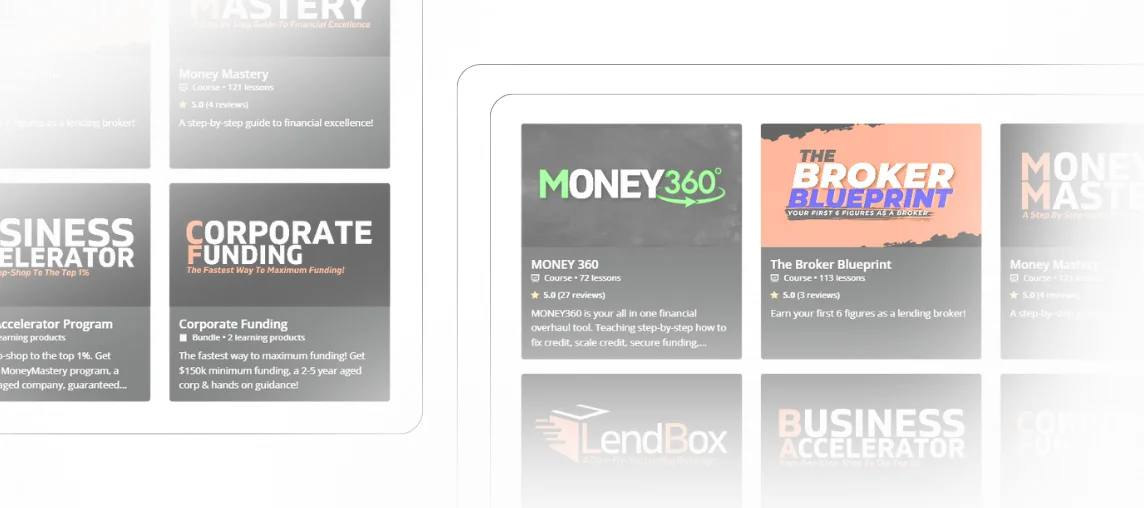

Ongoing Education

Enhance your business and financial acumen with our extensive range of educational courses, constantly updated to keep you ahead in a dynamic business world.

- info@aicreditfunding

- 623-206-5820

- 15284 w Elm St. Goodyear, AZ 85395

Blog Articles

- Copyright © 2026 AI Credit Funding. All Rights Reserved.